Direct Private Lending & Investment Advisory

Apply Now

Residential Real Estate Investors, Homebuilders and Developers

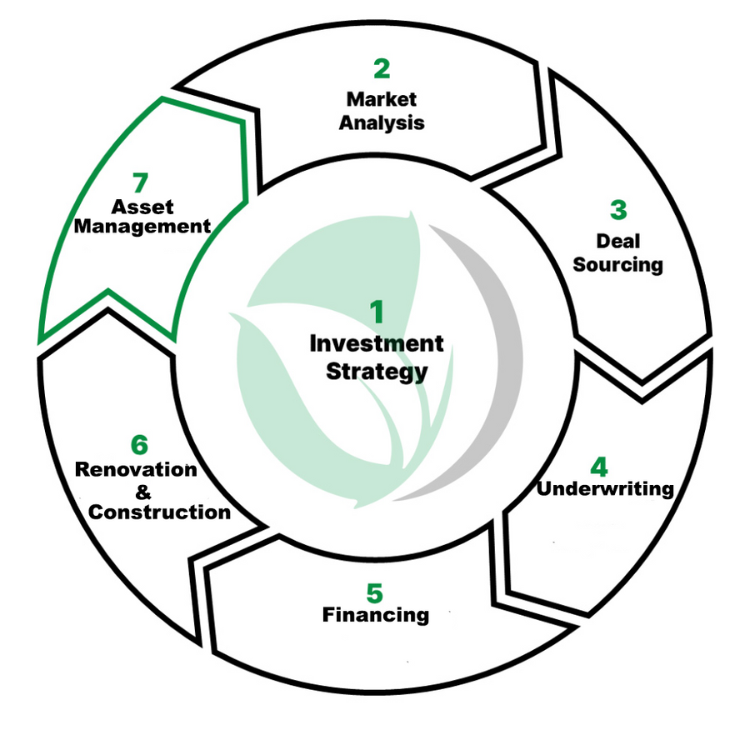

Aligned with our 7 Pillars of Profit framework, our advisors meticulously structure lending products and provide tailored advice for residential real estate investors, homebuilders, and developers. We prioritize your overall portfolio and profitability goals, ensuring strategic guidance that aligns seamlessly with your unique objectives, all without jeopardizing speed. Our streamlined process ensures loan closures in around two weeks, combining efficiency and effectiveness for your financial success.

Products

Loan Programs & Underwriting Guidelines

Fix & Flip

Funds to purchase + rehab

$50,000 to $5,000,000

Interest rate 10.24 - 12.75%

85% of Purchase Price + 100% of Rehab Budget

Close in 10-15 business days

Single Property Rental

30 year term loans

$75,000 to $2,500,000

Interest rate from 7.5%

Up to 80% LTV

Close in 3 weeks

Rental Portfolio Program

Blanket term loan for multiple properties

$250,000 to $50MM

1-4 unit properties/PUDs/warrantable condos/townhomes/5-8 unit MF

Up to 80% LTV

Ground Up

New construction loans

$50,000 to $5,000,000

Residential and commercial

85% of total project costs

No experience on a case by case basis

Your Single Source Financing Partner

Access Our Robust Private Capital Markets Platform

Property Types

- SFR (1-4 units)

- Multifamily (5+ units)

- New Home Construction

Lending Areas

Efficient Process

Additional Support for Client Partners

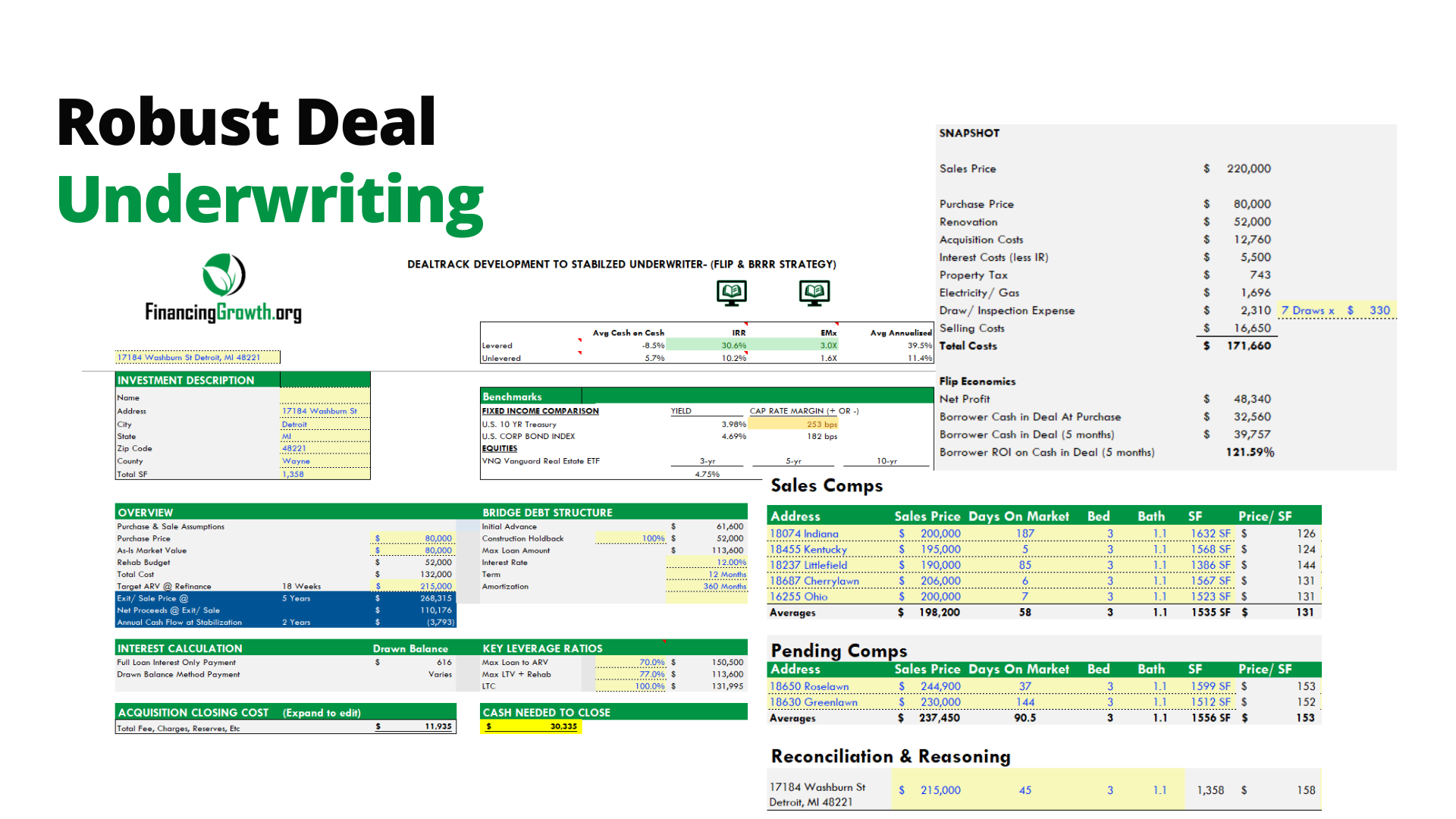

The investment merits of your project is critical for success. As your financing partner, we’re always here to help you underwrite a property’s key metrics such as IRR, Cap Rate, ROI, Cash Flow and Equity Multiple.

Learning Center

Frequently Asked Questions

What is a hard money loan?

Hard money loans are asset-based financing arrangements traditionally secured by the value of real estate properties, prioritizing the property’s equity over the borrower’s creditworthiness. Historically associated with distressed situations, the term “hard money” has evolved. In contemporary usage, it typically denotes non-bank, non-traditional private lending institutions. These entities extend loans to real estate investors, considering a combination of factors such as creditworthiness, experience, and, critically, the economic viability of the property and the investment strategy.

Do you lend on owner-occupied houses?

Financing Growth operates as a commercial lender, specializing in loans designed for business purposes rather than individual or personal interests. It’s important to note that we do not offer funding for the acquisition of owner-occupied residential properties.

Do you lend to foreign nationals?

Certainly! We offer financing options for foreign investors with a green card under both our short-term and long-term programs. A comprehensive US credit profile can often result in no impact on leverage and pricing. However, in cases of limited credit history, adjustments to leverage and pricing may apply.

How does my credit score influence the approval process for my application?

Our loans are asset-based, meaning the primary security for the loan is the real estate collateral. While the borrower’s credit score is considered during the underwriting process, our bridge programs generally require a credit score of 620 or higher, and our long-term loan programs typically necessitate a credit score of 660 or higher. If your credit score falls below our specified guidelines, you have the option to collaborate with a partner, who would then need to be included in the loan to meet the qualification criteria.

In which states do you provide lending services?

Financing Growth has the capability to extend lending services to a majority of U.S. states, excluding Alaska, North Dakota, South Dakota, Vermont, and West Virginia.